Limit the petty cash replenishment amount to a total that will require replenishment at least monthly. Internal control over cash and other operating assets promotes efficiency and works to minimize the risks of unlawful use acquisition or disposition of assets by unintended personnel.

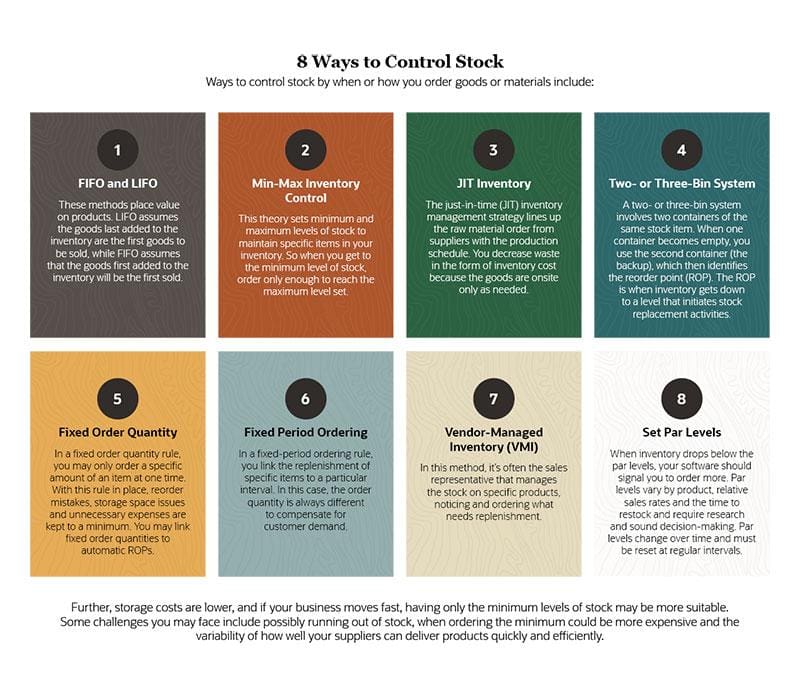

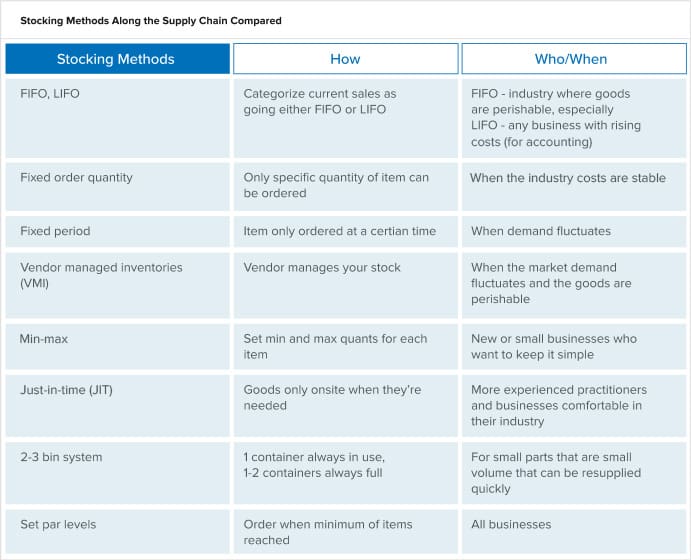

Inventory Control Defined Best Practices Systems Management Netsuite

In situations in which a physician refuses to take the responsibility for signing checks make sure the endorsements on the back of the canceled checks are reviewed.

. Safeguarding its assets against fraud wast abuse and inefficiencies. The Internal Control Framework which can be implemented by organizations of all sizes and types focuses on five integrated components of internal control. Every medical practice must implement specific internal controls to protect it from revenue loss and potential employee embezzlement.

It is used to. It can be defined as the set of methods and procedures used by a company to ensure that its results are reliable protection of the companys assets efficiency in the. Internal controls are the systems used by an organization to manage risk and diminish the occurrence of fraud.

Effectiveness and efficiency of operations. Use understanding of internal control for audit planning. It is necessary for every owner within a medical practice to analyze their current operations and habits and work to find better ways to manage costs revenues.

Then you can work with your financial team and outside professionals to establish smart internal controls that will protect your practice from the debilitating damage and destruction employee fraud can cause. In fact many medical organizations face increased scrutiny from regulators and legislation so internal controls are even more important to businesses in this industry. The purpose of internal controls in an organization is to reduce losses.

Keep patient funds separate from petty cash funds. When designing internal control policies there are some common risks. Internal controls are methods put in place by a company to ensure the integrity of financial and accounting information meet operational and.

These controls should be re-evaluated on a routine basis to ensure that they are operating properly and still meet their objectives. Top Ten Things to Strengthen Internal Controls in the Office 1. Here are a few strategies that healthcare practices can implement to minimize losses.

It does this in a flexible reliable and cost-effective approach says COSO. They provide reliable financial reporting for management decisions. Every medical practice large or small should have a set of policies and procedures over internal control.

One of the two approved internal control frameworks. The use of internal controls differs significantly across organizations of different sizes. The correct answer is.

Learn more about medical coding and billing training jobs and certification. Reconcile the petty cash fund before replenishing it. What is a system of internal control.

Poor or excessive internal controls reduce productivity increase the complexity of processing transactions increase the. They are the things we do to promote efficiency reduce the risk of loss help ensure our financial reports are accurate and comply with laws and regulations. Although there will never be a guarantee that employee embezzlement fraud or similar defalcations will be caught a practice can still minimize these activities by.

Companies use strong internal controls to guarantee that loss is eliminated. In the case of small businesses implementation of internal controls can be a challenge due to cost constraints or because a small staff may mean that one manager or owner will have full control over the organization. Although there will never be a guarantee that employee embezzlement fraud or similar defalcations will be caught a practice can still minimize these activities by implementing and monitoring sound internal controls.

Ideally internal controls should be risk based. Protect checks against fraudulent use. Complying with laws and regulations.

Control environment risk assessment control activities information and communication and monitoring activities. Determine whether controls have been placed in operation. Good internal controls are essential to assuring the accomplishment of goals and objectives.

These types of controls consist of the following. Internal controls are the procedures and practices we implement to help our organizations achieve their mission. Deface and retain voided checks.

The effectiveness of internal controls is directly. A system of internal control consists of measures used by an entity for the purpose of. When performing an audit auditors will look to see that they can gain assurance over a process by focusing on four main types of internal controls.

The best internal controls for accounts payable are a to limit check-signing authority to the physician and b to attach a vendor invoice to each check when it is signed. Prohibit writing checks payable to cash. Internal Controls in a Medical Practice - Part I Every medical practice must implement specific internal controls to protect it from revenue loss and potential employee embezzlement.

Proper training of those who will be carrying out the controls is an important aspect of a properly designed internal-control plan. As these are being evaluated and developed it is important that the risk of fraud be considered. At the most basic level it means that no single individual should have control over two or more phases of a transaction or operation.

IT Dependent Manual Controls. As you implement controls be mindful that all of the controls systems are dependent upon people. The four types of internal controls mentioned above are.

46 Describe Internal Controls within an Organization. The Government Accountability Office GAO Standards for Internal Control in the Federal Government commonly called the Green. Ensure Duties Are Segregated Segregation of duties is a basic key internal control and one of the most difficult to achieve.

Record management is pivotal for many business operations. Reliability of financial reporting. Management systems and policies for reasonably documenting monitoring and correcting operational processes to prevent and detect waste and to ensure proper payment.

They ensure compliance with applicable laws and regulations to avoid the risk of public scandals. The internal control structure is made up of the control environment the accounting system and procedures called control activitiesSeveral years ago the Committee of Sponsoring Organizations COSO which is an independent private-sector group whose five.

What Are Some Common Examples Of Segregation Of Duties

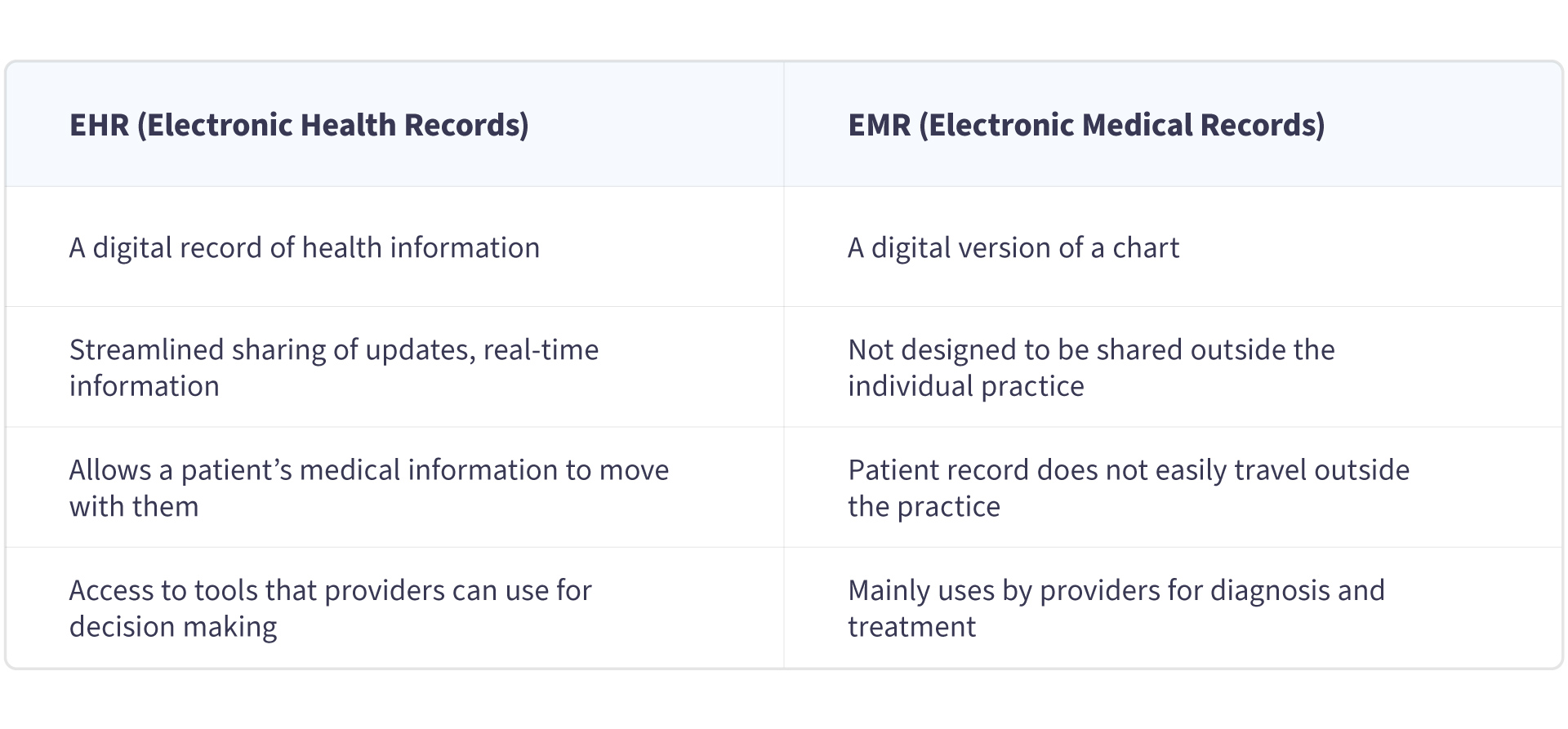

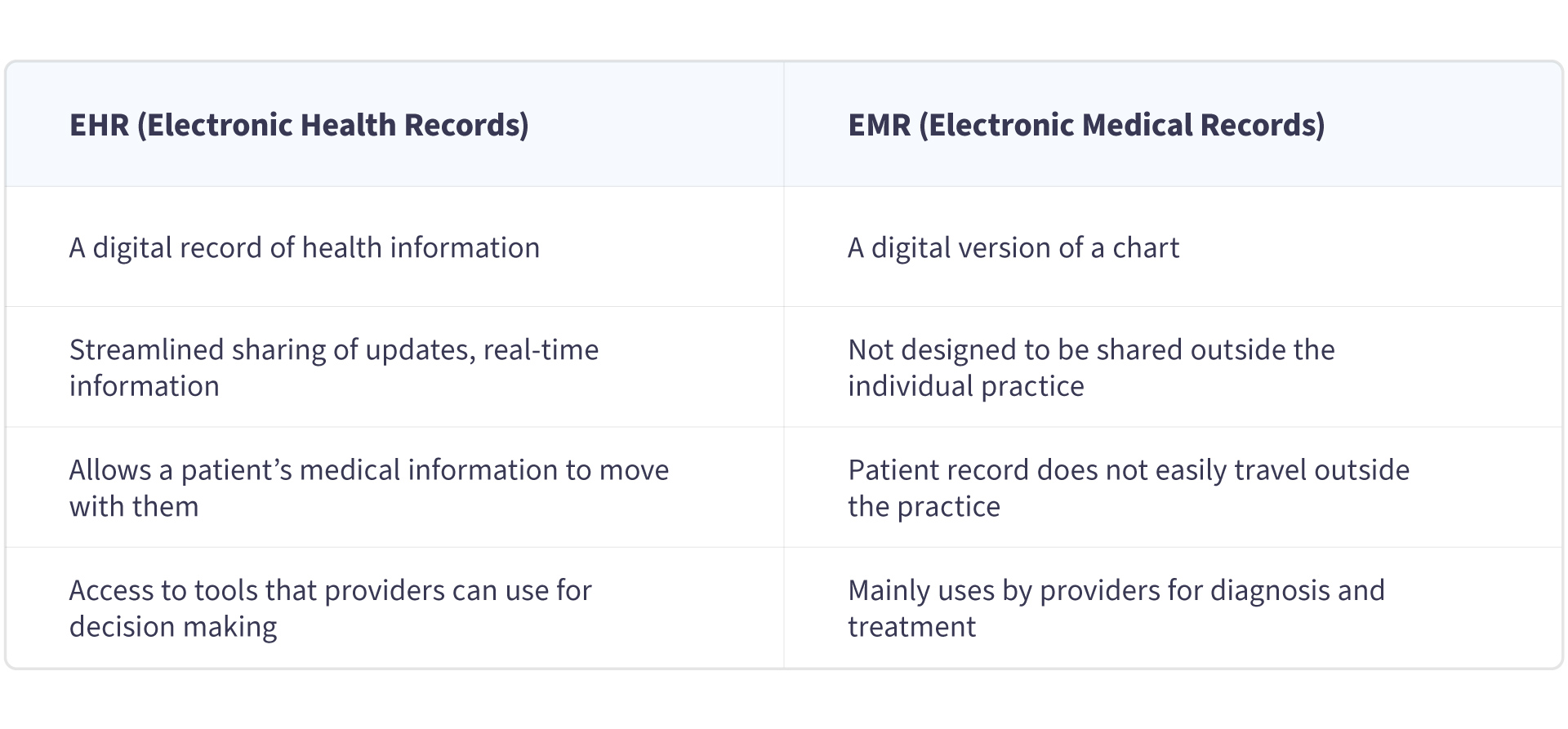

What Is Ehr Benefits And Disadvantages Nix United

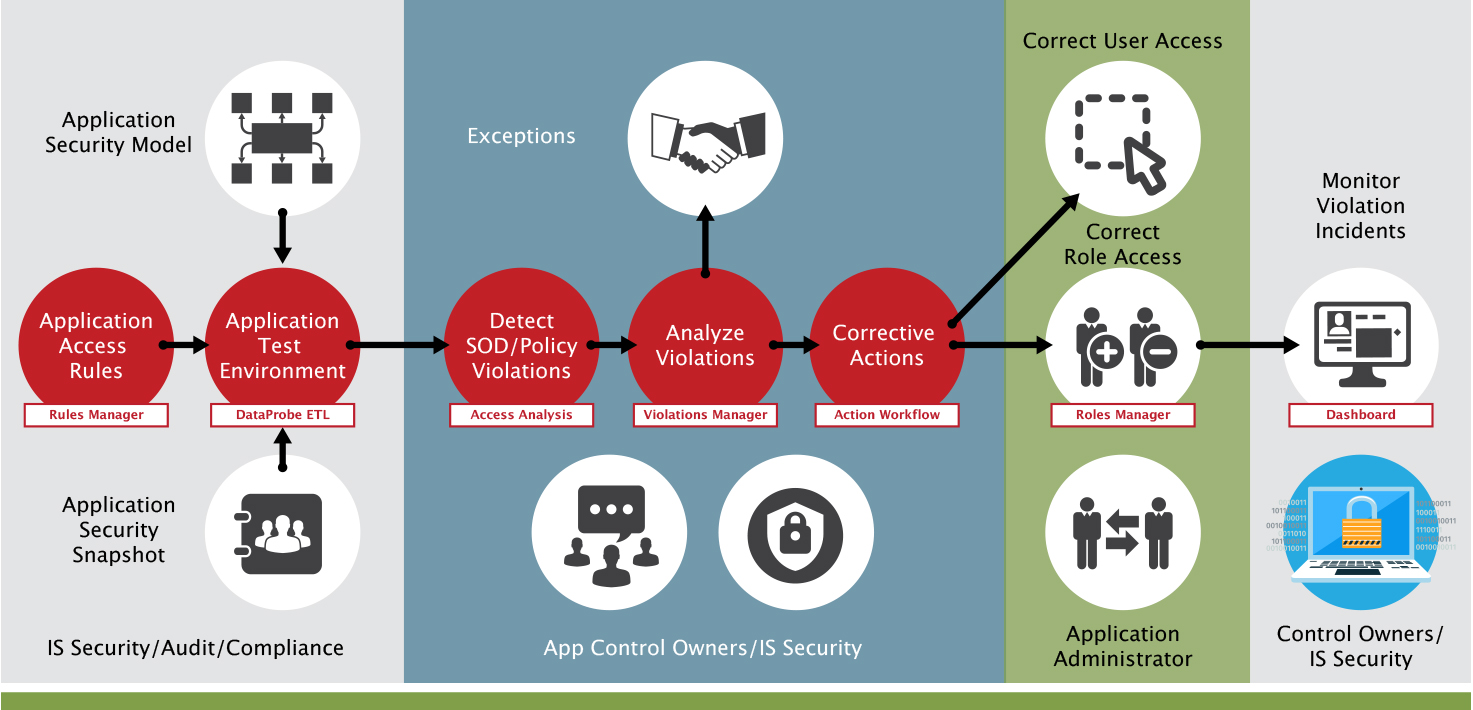

Aacc Guidance Document On Management Of Point Of Care Testing Aacc Org

Inventory Control Defined Best Practices Systems Management Netsuite

0 Comments